Save Money by Negotiating Your Agent’s Commission as a Buyer

Just because you are the buyer in the transaction does not mean you can’t take advantage of negotiable commissions. All agent commissions are negotiable.

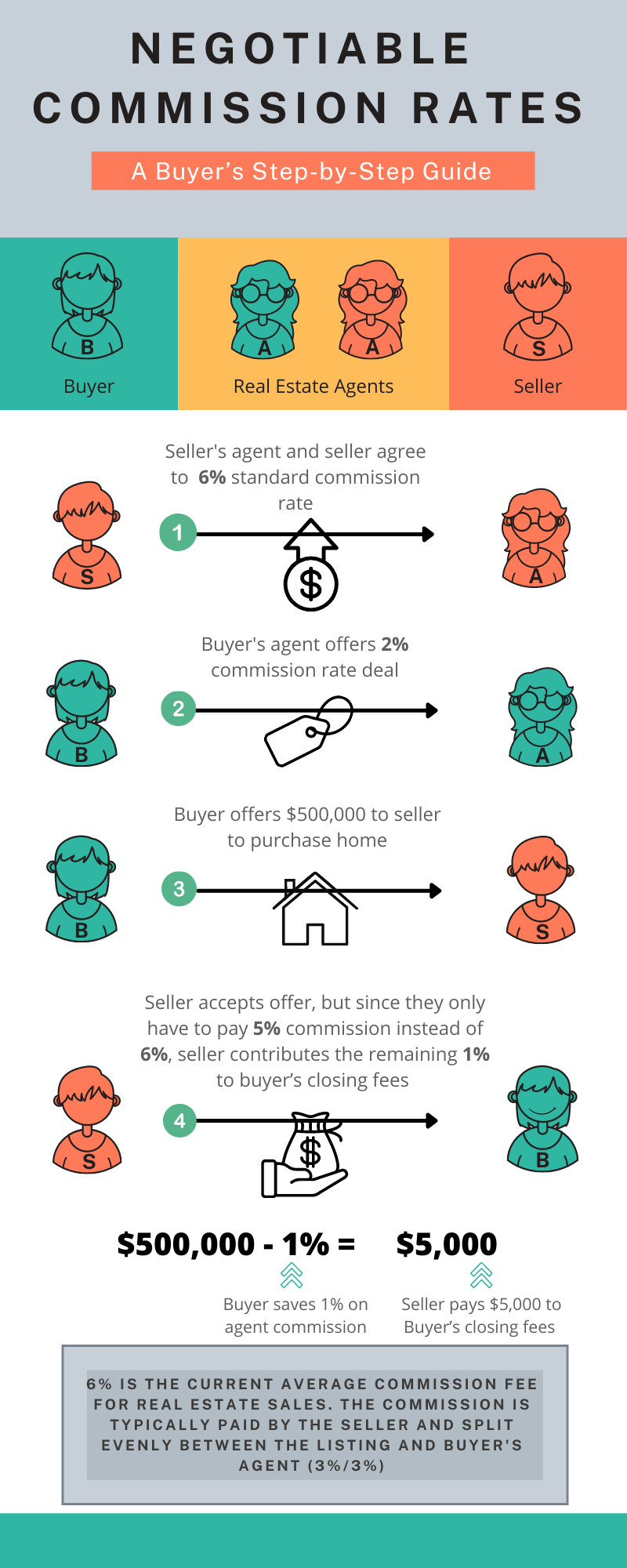

In real estate, the industry standard for agent commissions is 6% (3% going to the listing agent and 3% going to the buyer’s agent). Most agents stay firm to their 3% charge. Why? Could be for a variety of reasons. For example, it’s possible that due to their broker fees, reducing their rate makes the transaction unprofitable for them. Whatever the reason may be, it’s important to know, as a buyer, you are free to shop around and find an agent that offers a rate you prefer.

Note: If you are a buyer that is going to need a lot of help in the home buying process, even agents that offer negotiable rates may be reluctant to work for under 3%. Negotiable rates tend to be advantageous to seasoned buyers that don’t need as much assistance.

If you are represented by an agent that is willing to reduce their commission rate, make sure your agent is using the commission savings towards YOU. You have to be sure to include in the contract how those savings are to be used, otherwise, the listing agent can pocket the savings.

How could the listing agent pocket the savings? When a seller and listing agent create a contract to sell a home, the listing agreement will include the total commission fee for the home sale (usually 6%). Once the home is sold, the listing agent is the one who pays the buyer’s agent (usually 3%). If the buyer’s agent only charges 2% to their client but doesn’t dictate how the remaining 1% is to be used, the listing agent can take with them 4% of the commission. YIKES!

There are many ways you can utilize your commission savings. You can use that savings towards closing costs (recommended), house price reduction, or even as a check from your agent.

I would highly recommend not getting the commission savings in the form of a check because you will potentially get double taxed. First, the agent will get taxed for receiving it as commission/income (which they will take into account when giving you funds) and then if it’s over $16,000, you will get taxed for the amount over $16,000 from the IRS for gift tax unless you apply it to your lifetime gift exclusion (in Texas, you can gift someone $16,000 a year tax free).

Interested in a rate under 3%? Let’s chat!

Check out my other blog posts!

Realtor Responsibilities on Selling and Buying

Benefits of Using the MLS (Multiple Listing Service)